What’s going on with Tinder?

User numbers are falling, the app feels broken, and even Gen Z is logging off. The dating giant is in trouble – here’s why.

Let’s rewind. Not to 2015, not even to the early days of Tinder — we’re going all the way back to the early ’90s.

The Internet is an empty space. Google? Still a wet dream. And a guy called Gary Kremen buys a few domains that will soon be worth millions: Jobs.com. Sex.com. Match.com.

His idea? Take lonely hearts ads from the newspaper and put them online.

In 1995, he launched Match.com — and accidentally invented online dating.

Back then, dating online wasn’t cool.

It had a sketchy vibe. People didn’t brag about it at dinner parties. And it wasn’t cheap, either.

In the early 2000s, a Match.com subscription cost $25 a month. Adjusted for inflation, that’s about $44.

Because of this, for a long time, online dating stayed niche.

Then, in 2012, everything changed. With a swipe.

The app that turned dating into a game

The company behind Match.com, now called Match Group, wanted to try something new. Something fresh.

So they launched a new app. Clean UI. Super simple setup.

Log in with Facebook. Upload a few pics. Start swiping.

Swipe left = no. Swipe right = yes. If it’s mutual? It’s a match.They called it Tinder. And within months, it was everywhere. On phones, in conversations, and low-key in everyone’s pocket.

No long bios. No awkward icebreaker questions. No personality test nonsense. Just: Do you like their face or not?

And it worked.

By 2014, people were swiping over a billion times a day. Tinder wasn’t just the one of many dating app anymore — it became the dating app. A verb. Maybe even a lifestyle.

For an entire generation, Tinder was the place where dating started.

But while the app was blowing up, the business model wasn’t.

Everyone was swiping. No one was paying.

Tinder was free.

No ads. No subscriptions. No revenue.

It was growing like crazy, sure. But it was also burning cash and completely dependent on its mother, Match Group, to keep the lights on.

That’s fine for a while. It’s how a lot of tech companies work.

But at some point, the investors want more than daily active users. They want dollars.

So Tinder had to do what every “free” app eventually does: start charging.

Tinder Plus. Tinder Gold. Tinder Casino?

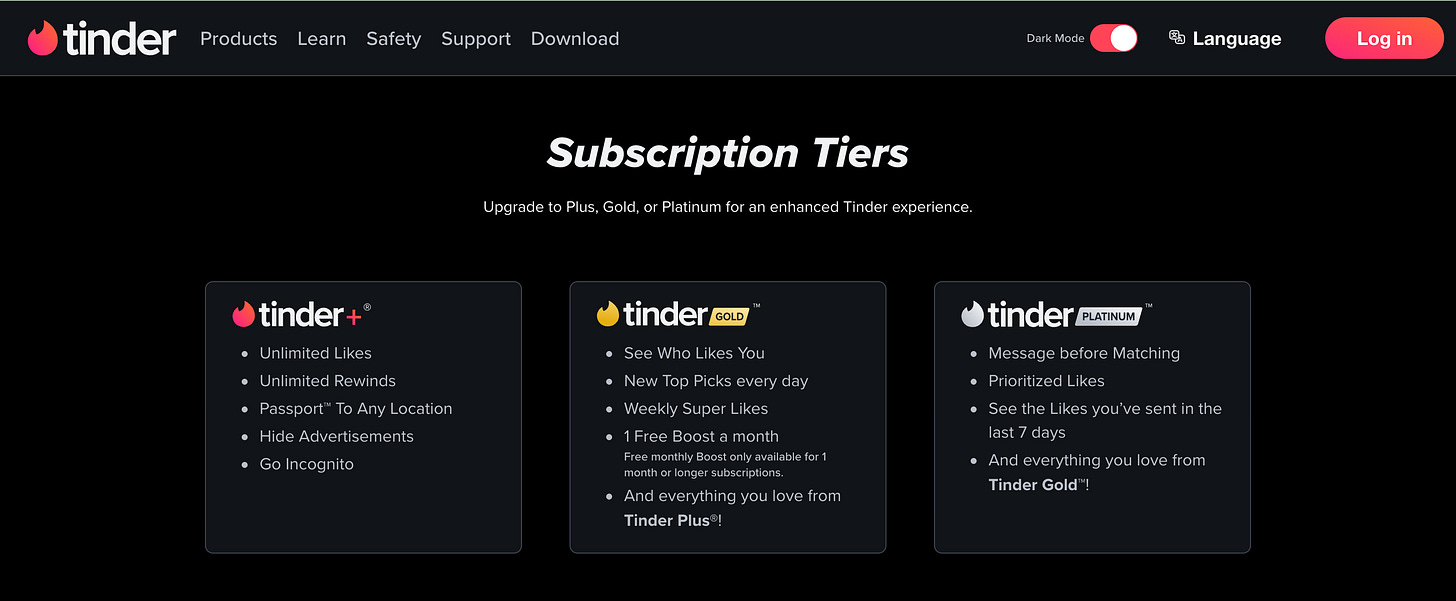

In 2015, they launched Tinder Plus — unlimited swipes and a few other perks.

Then came Tinder Gold, Tinder Platinum, and finally Tinder Select — an invite-only membership that costs $500 a month.

And then came the microtransactions.

Want to see who liked you? Pay. ✅

Want to skip the line? Pay. ✅

Not getting matches? Maybe pay to boost your profile. ✅

Slowly but surely, Tinder turned into a dating-themed slot machine.

You still swiped. But the odds started feeling rigged.

Free users got less. Paid users got more. Surprise!

And everyone got frustrated.

At first, it still worked.

In 2022, Tinder had 11 million paying users. For comparison: Substack has 5M at the moment. Statistically speaking, there's a spot with your name on it. 😉

But that was the peak.

The user curve flips. And not in a good way.

Since late 2022, Tinder’s losing users. Not just stalling, but actually shrinking.

And not random stragglers. The ones leaving are mostly young people. Gen Z. The future of the platform.

Why?

Let’s be honest: the experience kinda sucks now. I’ve, uh, heard stories.

Too many bots. Too much ghosting. Too many creeps. Too many men.

For women? Overwhelming.

For men? Demoralizing.

One study found that almost half of users had negative experiences with dating apps.

In the UK, just 25% of young women still use them — compared to 47% of young men.

That imbalance kills the vibe.

If women disappear, men lose interest. If men disappear, there’s no app left.

It’s the same reason your favorite nightclub lets women in for free: more women means more men — and more drinks being bought. Simple incentive design.Meanwhile, the empire is crumbling

Match Group isn’t just Tinder.

They also own Hinge, OkCupid, PlentyOfFish, The League, and a dozen other apps.

At one point, they had 60% market share in US online dating. A monopoly, basically.

But the stock tells a different story.

Since 2021, Match Group’s value has dropped over 80%.

Subscriber numbers are down.

Revenue is flat.

And even the competition’s struggling.

Bumble, Tinder’s biggest rival, just laid off 30% of its staff.

This is not just a Tinder problem, but an industry-wide crisis.

Monetization burnout is real

Now, Match Group has three levers to pull. None of them look good.

1. Get more users to pay.

Tough when even existing subscribers are bailing. Tinder dropped from 11+ million to under 10 million paying users in just over a year.

2. Grow the user base.

Also tough. Gen Z is leaving. The vibe is off. The brand is tired.

3. Run more ads.

Sounds logical — Tinder has tons of personal data.tind

But it doesn’t know much about you outside of your dating habits.

And ads next to your flirty messages? Bad UX.

Right now, ads make up less than 2% of Match Group’s total revenue.

That number probably won’t change much.

AI to the rescue (maybe?)

Tinder’s new strategy: artificial intelligence.

Smart features to choose your best photos. Write your bio. Even suggest matches.

Will that fix anything?

Probably not. Because here’s the truth:

People are tired.

They’re burned out. They want real connection, not gamified attention traps.

They want dating to feel like dating — not like a slot machine that punishes you for not spending.

And the more Tinder tries to optimize, the worse the experience feels.

So what now?

Tinder isn’t dead.

But it’s no longer cool. Or fun. Or hopeful.

What started as a fresh, fun, “what if dating was mobile-first?” idea…

now feels like an overpriced, underdelivering machine that’s more interested in monetizing your loneliness than solving it.

Even Match Group seems to realize that.

They’re already pivoting toward those “social discovery” — apps to find hiking buddies, roommates, game-night friends.

Not just dating. Just… human connection.

Because maybe the next big thing in dating isn’t dating.

Maybe it’s something softer. Something slower. Something a little more real.

The dream is fading

Tinder changed the way people meet.

It took dating online, mainstream, mobile — and made it feel like a game.

But the game has gotten stale and the love story has lost its plot.

And now, a whole generation is asking:

What’s the point of all these apps if no one’s actually falling in love?

Maybe the next dating revolution won’t come from a $10B startup.

Maybe it’ll just come from talking to someone. IRL. In line for coffee. At a friend’s party. In the rain, under a broken umbrella.

Maybe even through writing…

No swipe needed.

Cheers 🥂

~Jannis

It’s interesting you mentioned tinder, I haven’t used it but hear a similar sentiment amongst those who do.

Dating service business models are interesting because, somewhat like cigarette sellers, they hinge upon destroying their own customers. Pair people up too well and — as a species that broadly favours monogamy — they'll do selfish things like entering long-term relationships, and stop paying for your app.

In the Netherlands we have a startup called Breeze. Their app is growing and now getting more international recognition. It’s an app where you can’t chat, can only like 14 profiles a day and when you match you have to pay to go on a first date. It works like hell and they seem to have less of a monetisation problem this way.

The effect of this method is that you really aim to show yourself in your profile and only like people who you think are a big chance to match.