Beyond Meat’s Billion-Dollar Miscalculation

Inside the rise, hype, and unraveling of a $13B food tech dream

Let’s rewind to 2009, a year still reeling from economic chaos.

The global financial crisis had left millions unemployed. Markets were crashing. Consumer confidence? Basically nonexistent.

But while Wall Street panicked, one man was simply getting bored.

His name? Ethan Brown. Late 30s. Secure job in the energy sector. Excellent salary and a comfortable life — but no spark.

So he quit.

Brown didn’t just want a new job — he wanted purpose. A mission. Something that made sense not just on a spreadsheet, but on a deeper level.

And strangely enough, he found that purpose in a greasy memory: the Double R Bar Burger from Roy Rogers. A symphony of beef, bacon, and cheese. 600 calories of pure Americana.

There was just one problem: Brown was now vegan.

So he set out to do the impossible — recreate the burger he loved, without harming a single animal.

That mission became a startup. And that startup became one of the most talked-about food tech companies of the next decade:

Beyond Meat.

A vegan burger… for meat lovers?

From the very beginning, Beyond Meat wasn’t made for vegans. It was designed for meat eaters who simply wanted to eat less meat. A crucial distinction.

Brown teamed up with scientists from the University of Missouri, who were experimenting with soy and plant proteins. After years of trial, error, and taste-testing failure (seriously, Seitan-only patties? No thanks), they struck gold:

Pea protein, spices, and beet juice.

Beet juice wasn’t added for flavor — it mimicked the “bleed” of beef. Suddenly, a plant-based patty didn’t just taste better. It looked and felt like real meat.

The Beyond Burger was born.

And in 2016, Whole Foods took it nationwide. Not in the vegan aisle — in the actual meat section. Right next to ground beef.

Game on.

Sizzle, then boom

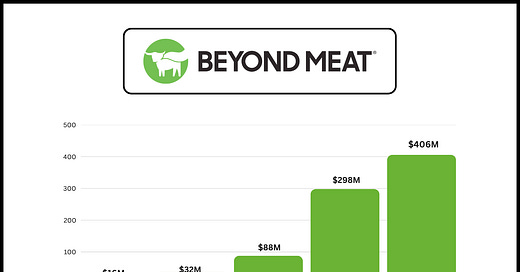

From 2016 to 2019, Beyond Meat was everywhere.

Sales doubled. Then tripled. Then tripled again. Celebs like Leonardo DiCaprio, Snoop Dogg, and Kim Kardashian invested or endorsed. Even German finance bro Christian Lindner (yes, the “better not govern than govern wrongly” guy who then governed wrongly and quit afterwards) posted about it.

By 2019, Beyond Meat IPO’d at $25. By market close? $65.75. One of the most successful U.S. public debuts in a decade.

Brown became a near-billionaire overnight. Investors were hyped. Consumers were curious. Supermarkets stocked up.

And then came the next move: fast food.

Beyond Meat struck deals with KFC and McDonald’s to put plant-based patties in drive-thrus. The vision? Not just a supermarket brand — but a full-on meatless McEmpire.

But scaling comes with cost. And cracks were about to show.

Too fast. Too furious. Too… sausage-y?

To grow fast, Beyond Meat expanded its product line: sausages, meatballs, chicken strips. Some were fine. Others?

Let’s just say one version of their plant-based sausage collapsed on shelves if stored vertically. Seriously.

Internal emails revealed they skipped key product testing just to hit deadlines.

Meanwhile, R&D spending ballooned. So did production costs. And salaries. And operations. In 2022 alone, they spent over $600M — with revenues going the other way.

Losses piled up, margins evaporated, and in March 2021, they took out $1B in debt to stay afloat.